Our Blog

March 15, 2024

What Can I Do if Road Debris Leads to an Accident?

March 01, 2024

Why are Witnesses Important in a Truck Accident Case?

February 16, 2024

Should You Call the Police Immediately After an Accident?

February 5, 2024

Recent Serious Injury Crash in Clearwater

January 24, 2024

What Are the Most Common Types of Personal Injury Cases in FL?

January 11, 2024

Do Car Accident Lawyers Help You File Insurance Claims?

December 18, 2023

Bridge Accidents in St. Petersburg and Clearwater, FL

December 4, 2023

Does Auto Insurance Cover Bicycle Accidents in Florida?

November 27, 2023

Different Types of Traumatic Brain Injuries from Accidents

November 10, 2023

Determining Fault When a Car and Bicycle Collide

November 01, 2023

Serious Injuries Suffered in a Rideshare Accident

October 15, 2023

How are TBIs Treated?

October 01, 2023

What Should You Do if You Slip and Fall in a Mall?

August 12, 2023

A Clearwater, FL Accident Attorney's Insight into Handling Auto Accident Cases

August 3, 2023

When is a Company Liable After a Truck Crash?

July 25, 2023

Fighting the Insurance Company after a Car Accident

July 10, 2023

Can I File a Claim if I Lost a Loved One in a Truck Crash?

July 01, 2023

How Long Do I Have to Inform My Insurance Company I Was in an Accident in FL?

June 24, 2023

Don’t Ignore Minor Injuries; Always Seek Medical Care

June 19, 2023

Major Crash During First Lap of IndyCar Race

June 9, 2023

Navigating the Legal Landscape: How a St. Petersburg Car Accident Lawyer Can Help You Seek Justice

June 01, 2023

Do You Have to Go to Court for a Truck Accident?

May 23, 2023

As a Passenger, Can I Sue after a Car Accident?

May 15, 2023

Take the Right Steps in Hiring a Car Accident Attorney in Clearwater, FL

May 8, 2023

What Are Car Accident Attorney Fees in Florida?

May 01, 2023

Why Should You Hire a Clearwater Sexual Abuse Lawyer?

April 23, 2023

What to Do If Someone Flees The Scene of an Accident?

April 15, 2023

Florida Fender-Benders

April 8, 2023

What Happens if I Get into an Accident with No Insurance?

April 01, 2023

Someone Else Was Driving My Car and Got in an Accident, Now What?

March 23, 2023

Can I Share Fault with the Other Driver in an Accident?

March 15, 2023

Who is Liable for a Pile-Up Accident on a Freeway?

March 01, 2023

What If I Am a Witness in a Pedestrian Accident?

February 15, 2023

Why Hire a Car Accident Lawyer in Florida?

February 01, 2023

What If I Was Not Wearing a Seat Belt at The Time of My Accident? Can I Still Recover Damages?

January 25, 2023

Should I Release My Medical Records to Another Driver’s Insurance Adjuster?

January 20, 2023

Reckless Driving Accidents Increase During Colder Months

January 17, 2023

What If I Am At Fault for Causing The Accident?

January 10, 2023

What Damages Can I Recover in a Motor Vehicle Accident?

January 2, 2023

Common Legal Rights People Waive Without Knowing It

December 26, 2022

Can You Get Street Camera Footage to Use in Your Car Accident Claim?

December 18, 2022

What If You Are Hit by a Commercial Truck in Florida?

December 10, 2022

Should You Always Call a Lawyer After a Car Accident?

December 01, 2022

What to Do If You Fall in a Department Store?

November 22, 2022

Why Car Accidents and Deaths Increase During Thanksgiving Weekend

November 13, 2022

What Are The Risk Factors for Suffering Permanent Brain Damage After a Concussion?

November 3, 2022

What Are The Signs of Delayed Car Accident Injuries?

October 25, 2022

Do I Need an Attorney After Any Type of Auto Accident?

October 13, 2022

Are Red Light Runners Always Liable in Intersection Accidents?

October 5, 2022

Who’s Liable in an Accident Involving Bad Weather Conditions?

October 01, 2022

What Should I Expect After a Car Accident?

September 29, 2022

Underage College Drinking Leads to Severe Injuries and Death Across Campuses During Fall

September 26, 2022

Why Accidents Increase in Florida During Labor Day Weekend

September 23, 2022

What You Should Do After a Car Crash in Florida

September 21, 2022

What If The Person Who Hits Me Does Not Have a Valid Drivers License?

September 15, 2022

5 Sneaky Tactics Insurance Companies Use to Deny Claims

September 12, 2022

What to Do With Social Media If You Have an Active Case

September 6, 2022

Florida Drowning Accidents During the Summer

August 30, 2022

What Are Florida's Electric Bike Laws?

August 21, 2022

Steps to Take After a Fender Bender in St. Pete

August 10, 2022

How Social Media Can Harm Your Case

August 5, 2022

What to Do When You Get into a Car Accident Out-of-State

July 27, 2022

Why is Tragos, Sartes & Tragos the Right Law Firm for Me?

July 14, 2022

Tragic Truck Crash on I-75 Kills Clearwater Residents

July 05, 2022

Can You Sue for Emotional Distress After a Truck Accident?

June 24, 2022

Should I File a Claim in a Slip and Fall Case?

June 15, 2022

What To Do If You Slip & Fall In a Resort or Casino

June 07, 2022

Is Your Insurance Company Really On Your Side?

May 29, 2022

What Should You Do When You Slip and Fall in a Store?

May 20, 2022

Can a Passenger Be Responsible for Causing an Accident?

May 12, 2022

What Should I Do If a Driver Offers Me Cash After an Accident?

May 06, 2022

Liability When Medical Issues Lead to Crashes

April 29, 2022

Can I Still File a Claim If The At-Fault Driver Died in The Crash?

April 20, 2022

What to Do If You Fall in a Parking Lot in Tampa?

April 05, 2022

Who is to Blame If An Object on The Road Damages My Car in Clearwater?

March 24, 2022

Can I Ride a Scooter or Moped on a Florida Highway?

March 17, 2022

Signs of An Injury Can Show Up Days After a Crash in Tampa

March 10, 2022

What If The Person Who Hits Me in Tampa Does Not Have Insurance?

March 4, 2022

How Do You Handle Property Damage Claims in FL?

February 25, 2022

What If I am a Witness in an Auto Accident?

February 18, 2022

Steps to Take After Someone Hits Me Who Doesn't Have Insurance

February 11, 2022

Does Posting Caution and Warning Signs Protect Businesses in Slip and Fall Cases?

February 4, 2022

Text Messages Can Impact Your Criminal Case

January 27, 2022

Why You Need a Good Criminal Defense Attorney

January 23, 2022

What Happens if I’m Partially at Fault for the Accident?

January 20, 2022

How Are FL's New Bicycle Laws Working Out?

January 17, 2022

Who is Liable for an Accident Involving Multiple Cars on a Highway?

January 13, 2022

Who is To Blame If an Object in The Road Caused My Accident?

January 7, 2022

Determining Liability in a Florida Uber or Lyft Accident

December 31, 2021

Tips for Avoiding Pedestrian-Car Accidents During the Holidays

December 30, 2021

Should I File a Claim in a Truck Accident?

December 27, 2021

Is it Safer to Ride Your Bike on The Sidewalk or in The Bike Lane in FL?

December 21, 2021

Determining Who is At Fault in a Motorcycle Accident

December 14, 2021

What are Common Injuries From Pedestrian Accidents?

December 5, 2021

Most Common Injuries After a Truck Accident

December 3, 2021

Were You Injured in a Traffic Accident Over Thanksgiving?

November 30, 2021

Do I Need an Attorney After Any Type of Accident?

November 24, 2021

Rise in Auto Accidents Around Tampa Bay

November 17, 2021

Understanding Your Rights When You Hire an Injury Attorney

November 10, 2021

What to Do After a Hit and Run Accident?

November 3, 2021

Accidents During Whiteout RainStorm on The Highways

October 26, 2021

What are Tampa's Motorcycle Helmet Laws?

October 18, 2021

How are Motorcycles More Dangerous Than Cars on The Road?

October 13, 2021

Nursing Home Abuse in Florida During Covid-19

October 4, 2021

What Are The Biggest Causes of Auto Accidents in FL?

September 30, 2021

What If My Car is Damaged in a Car Accident?

September 28, 2021

Should I Sue My Uber or Lyft Driver for a Rideshare Accident?

September 20, 2021

Self-Driving Delivery Cars

September 14, 2021

How to File a Wrongful Death Lawsuit in Florida

September 10, 2021

Can I Sue a Rental Car Agency if the Car is Defective?

September 5, 2021

Causes of Motorcycle Injuries

September 1, 2021

Can You Film Police Officers?

August 31, 2021

Hurricane Preparedness: What Do You Need to Know?

August 20, 2021

Can You Get Surveillance Footage of Your Accident?

August 13, 2021

Florida Ranks in Top Three Most Dangerous States for Kids in Vehicles

August 4, 2021

Sharing the Road with Self-Driving Trucks

July 31, 2021

Common Boating Accident Statistics in Florida

July 17, 2021

Florida Civil Cases: Statutes of Limitations

July 12, 2021

Injured while on Vacation, Where Do I Get an Attorney?

July 6, 2021

Pedestrian Accidents on the Rise in St. Pete

July 1, 2021

What is PIP?

June 21, 2021

What Happens if You are Injured on a Rented Bicycle?

June 14, 2021

Who is Liable for a Trip and Fall on a Sidewalk?

June 7, 2021

How Can Insurance Companies Deny Your Accident Claim?

June 1, 2021

Risks of E-Scooter Rentals in St. Petersburg and Tampa

Wrong Way Driving Accidents in Tampa Bay

What Is Mediation?

Accident Caused by an Object in the Road, Who Is to Blame?

Do I Sue the City if a Pothole Caused My Accident?

How Car Insurance Works

What Happens if I Crash My Car and It's Leased?

If in a Car Accident, How Much Can You Sue For?

Pedestrians are at High Risk on Florida Streets

Drowsy Driving Similar to Drunk Driving

Does a Posted Caution Sign Protect a Business in a Slip and Fall Case?

The Difference between Car Accident and Truck Accident Cases

Will Your Health Insurance Cover Injuries Caused by a Car Accident?

Who Is Liable for Accidents Involving Multiple Cars?

Are Self-Driving Trucks Safe to Be on Our Roads?

Will the FMCSA Require Inspections of Underride Guards?

What to Do after a Truck Accident in Florida

Who Is Liable in a Truck Accident (and How to Prove It)?

What to Expect During a Nursing Home Abuse Lawsuit

How to Prevent Nursing Home Abuse & Neglect

Things Nursing Homes in Florida Are Not Allowed to Do

How to Document a Slip and Fall Accident

Tips for Avoiding Pedestrian-Car Accidents

Key Factors That Can Affect Your Motorcycle Accident Claim

The Legal Requirements of Driving a Motorcycle, Moped, or Scooter in Florida

Tragos Scholarship Winner: The Future of Podcasting & The Legal Profession

Florida Solar Energy Laws, Incentives and Protections Impacting Homeowners

Contributed by Daren Goldin Until recently, Florida has lagged behind other states like California when it comes to solar energy. Unlike California

How to Handle Workplace Safety During Coronavirus

In this week's episode of Peter’s Proffer, host Peter Tragos and co-hosts George Tragos & Peter Sartes talk about their list of 5 don’ts for

Don’t Let Your Business Bust Because of COVID-19

Your company may be protected by business interruption insurance. Don’t know what that is or how to find out? Tragos Law can help you! What is

Is Your Loved One in a Nursing Home With Confirmed COVID-19 Cases?

By now you may have heard that on Saturday, April 18, Florida Gov. Ron DeSantis released a list of nursing homes and assisted living facilities (ALFs)

What Small Businesses Need To Know About the Paycheck Protection Program

In Episode 116 of Peter’s Proffer, the weekly podcast of our very own Peter Tragos, Peter takes listeners out of the “courtroom of current events” and

7 Steps to Prevent the Spread of COVID-19

The novel coronavirus (COVID-19) pandemic has affected all of us. Here at the law firm of Tragos, Sartes & Tragos, we’ve implemented an emergency

Families First Coronavirus Response Act

What does this mean for you: Families First Coronavirus Response Act President Trump signed the second coronavirus emergency aid act on March 18,

Alert: Coronavirus Disease (COVID-19)

A message from the Law Offices of Tragos, Sartes & Tragos. This is no doubt and extremely challenging time. In our country, and all around the

December 6, 2019

December 6, 2019

Tune Into ‘Peter’s Proffer’ – a Weekly Podcast Series from Tragos Law

Here at the Law Offices of Tragos, Sartes & Tragos, we serve the Tampa and Clearwater community in many ways. It may surprise you to learn that,

Tune Into ‘Peter’s Proffer’ – a Weekly Podcast Series from Tragos Law

Tune Into ‘Peter’s Proffer’ – a Weekly Podcast Series from Tragos Law

Here at the Law Offices of Tragos, Sartes & Tragos, we serve the Tampa and Clearwater community in many ways. It may surprise you to learn that,

Students Consider Whether Red Light Cameras Make Florida Roads Safer

In May 2018, the Florida Supreme Court ruled that red light cameras can stay. The court's decision to uphold a 2010 state law allowing local

Tragos Law Scholarship Winner: Do Red Light Cameras Improve Safety on Florida Roads?

To help a deserving student reach their academic goals and impress upon them the importance of lawmaking, the Law Offices of Tragos, Sartes &

5 Common Myths & Lies About Personal Injury Lawsuits

Have you been injured in an accident and aren’t sure what your next step should be — or if your situation even warrants a next step? There’s a

Bucket List

Normally, you get to read about George's latest successful completion of a "bucket list item". This time, I have the honor of writing the article

Tragos Law is a Proud Sponsor of the 2019 Look Up! Clearwater Music Festival

The Tragos, Sartes & Tragos Law Firm is proud to be one of the sponsors for the 2019 Look Up! Clearwater Music Festival. The 2nd annual music

Florida Assisted Living Facilities Don’t Have to Notify Family of Safety Issues

It may surprise you to learn that Florida law doesn’t require assisted living facilities to notify their residents’ family members when there’s a new

FJA Annual Mock Trial Competition

The Law Offices of Tragos, Sartes & Tragos are sponsoring the FJA’s annual Mock Trial competition on October 20-21, 2018, in Fort Lauderdale. To

We’re from the Insurance Company. We’re Here to Help.

People are constantly asking me why they need a lawyer when it is obvious that the person who caused the accident is liable and the other person’s

The #MeToo Movement

The #MeToo Movement

Today's podcast touches on the sensitive subject of sexual abuse. This movement in Hollywood has given a voice to these stories. In Florida, 11,200

A Florida Law Firm Full of Super Lawyers

A Florida Law Firm Full of Super Lawyers

For the second year in a row, the Law Offices of Tragos, Sartes & Tragos are proud to announce that all three lawyers in the firm have been listed

George Tragos Secures Release Of Wrongfully Convicted Man After 17 Years In Prison

George Tragos Secures Release Of Wrongfully Convicted Man After 17 Years In Prison

In 2001, Dwight Dubose was convicted of murder in Hillsborough County and sentenced to life without parole. On April 24, 2018, after 17 years in

Peter Tragos Appointed to Florida Bar’s Civil Procedure Rules Committee

Peter Tragos Appointed to Florida Bar’s Civil Procedure Rules Committee

We are excited to announce Peter Tragos’ appointment by the president-elect of the Florida Bar to serve on the Bar’s Civil Procedure Rules Committee.

How to Avoid The Accident

How to Avoid The Accident

Be Aware. First and foremost, be aware of your surroundings. Always scan your mirrors and be cautious of the person behind you. If someone is

Another Item Off The Bucket List – The Grand Canyon

Another Item Off The Bucket List – The Grand Canyon

Recently, I was able to cross off another item on my bucket list. While in Las Vegas, I took a helicopter ride through the Grand Canyon and over the

George Tragos Lends Expertise to News Reports on Wife of Pulse Nightclub Shooter

George Tragos Lends Expertise to News Reports on Wife of Pulse Nightclub Shooter

The wife of Omar Mateen, the accused shooter in the Pulse Nightclub massacre, was acquitted of all charges in federal court at the end of March. Noor

How To Pick an ALF: Keeping Mom and Dad Safe

How To Pick an ALF: Keeping Mom and Dad Safe

As many of you already know, our law firm represents the families of elderly and disabled persons that have been injured, and in some instances died,

Announcing the Tragos, Sartes & Tragos Podcast

Announcing the Tragos, Sartes & Tragos Podcast

It’s 2018 and we’re starting a podcast! Why? Well, we want to educate the general public so they don’t get taken advantage of by lawyers, doctors,

One Less Item on my Bucket List

One Less Item on my Bucket List

By George Tragos On May 19 through 21, 2017, I had the opportunity to play at famed Pebble Beach Golf Course. Anyone familiar with golf knows that

Safe Driving Tips for the Holidays

Safe Driving Tips for the Holidays

It's hard to believe that the 2017 holiday season is about to commence. It never ceases to amaze me how quickly the year goes by and we find

What to Do After an Out-of-State Car Accident

Knowing what to do after an out-of-state car accident is important. Getting into a car accident is never a pleasant experience. But if a driver

Clearwater Cruise Control Safety Tips

Cruise control is a great invention for people on long road trips. It eliminates the need to monitor one’s speed and may even save someone gas over

Car Accidents Caused by Animals in Clearwater

Florida’s diverse wildlife is part of what makes the state great. Unfortunately, animals can seriously damage a vehicle in the event of a collision.

Using Headphones While Driving in Clearwater

Florida law allows drivers to use cell phones while driving. While many states have outlawed the use of cell phones to text or even talk without a

Tips for Driving into the Sun in Clearwater

Whenever someone drives early in the morning or late in the evening, they run the risk of having to drive with the sun in their eyes. Driving eastward

Tips for Driving Safely Through Fog in Clearwater

When driving early in the morning, or through the mountains, it can be common to run into dense patches of fog. In these times, it is important to

Attorney Tragos Wins Best Program Award

Attorney Tragos Wins Best Program Award

The Law Offices of Tragos, Sartes & Tragos is pleased to announce that Attorney Peter L. Tragos was presented with the Best Program Award from the

Attorney Peter Tragos Appointed to FJA Young Lawyers Board

Attorney Peter Tragos Appointed to FJA Young Lawyers Board

The Law Offices of Tragos, Sartes & Tragos are pleased to announce that Attorney Peter L. Tragos has been appointed to the Florida Justice

Florida Self-Driving Vehicle Laws

Florida Self-Driving Vehicle Laws

For most of us, the fantasy of being so rich we have a limousine driver taking us wherever we want to go is very far from obtainable, unless we hit

Tragos, Sartes, & Tragos Attorneys Named to Super Lawyers and Rising Stars Lists

Tragos, Sartes, & Tragos Attorneys Named to Super Lawyers and Rising Stars Lists

The Law Offices of Tragos, Sartes & Tragos is pleased to announce that all three of our attorneys have been named to the Super Lawyers and Rising

John H. Meek, Jr. Memorial Golf Tournament

John H. Meek, Jr. Memorial Golf Tournament

On May 15, 2017, the Law Offices of Tragos, Sartes & Tragos sponsored a foursome in the John H. Meek, Jr. Memorial Golf Tournament. The event was

Judge Recuses Herself in USF Sexual Assault Case

Judge Recuses Herself in USF Sexual Assault Case

A Hillsborough County circuit court judge recused herself just one day after lambasting University of South Florida’s coach Charlie Strong for the

Attorney Peter Tragos Appointed Vice Chair of Traffic Court Rules Committee

Attorney Peter Tragos Appointed Vice Chair of Traffic Court Rules Committee

The Law Offices of Tragos, Sartes & Tragos is pleased to announce the appointment of Attorney Peter Tragos to serve as Vice Chair of the Traffic

Pinellas County Court Judge Dora Komninos Sworn In

Pinellas County Court Judge Dora Komninos Sworn In

Dora Komninos, a former assistant State Attorney, won the recent election for Division F, County Court Judge in Pinellas County, Florida. The seat was

FSU College of Law Alumni Association Reception

FSU College of Law Alumni Association Reception

The Law Offices of Tragos, Sartes & Tragos are pleased to announce our sponsorship of the Florida State University College of Law Alumni

Tragos, Sartes & Tragos Sponsors Bldg 28 Church Family Movie Night

Tragos, Sartes & Tragos Sponsors Bldg 28 Church Family Movie Night

Many of us remember how much fun it was when we were children to head to the drive-in movies with our family. Unfortunately, over the years, most

Tragos, Sartes & Tragos Sponsors Golf Scramble

Tragos, Sartes & Tragos Sponsors Golf Scramble

The Law Offices of Tragos, Sartes & Tragos was once again a sponsor of the annual Thomas M. Papadakis Memorial Golf Scramble. The event was

New Office Location in St. Petersburg

New Office Location in St. Petersburg

The Law Offices of Tragos, Sartes, and Tragos is happy to announce the opening of a third office, in St. Petersburg. This new office brings

Firm Hosts Reception for Florida Bar Candidate Suskauer

Firm Hosts Reception for Florida Bar Candidate Suskauer

The Law Offices of Tragos, Sartes & Tragos recently hosted a reception for Florida Bar president-elect candidate Michelle Suskauer. The reception

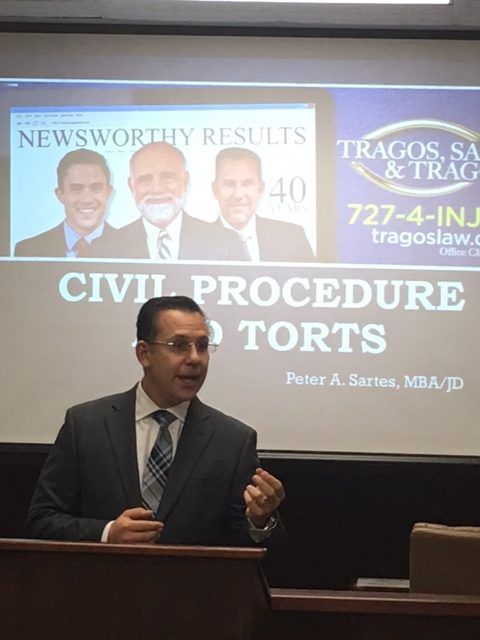

Attorney Sartes Teaches Seminar at People’s Law School

Attorney Sartes Teaches Seminar at People’s Law School

Attorney Peter Sartes, a partner at the Law Offices of Tragos, Sartes & Tragos, recently taught a seminar on Civil Procedure at this year’s

Uninsured Motorist Coverage

Uninsured Motorist Coverage

One afternoon we had a client come into our office whose daughter had died as a result of a motor vehicle accident. The at-fault party was driving

Tips for Military Appreciation

Tips for Military Appreciation

Congress designated May as National Military Appreciation Month in 1999 to ensure that our nation was given an opportunity to publicly demonstrate

The Job of a Criminal Defense Lawyer

The Job of a Criminal Defense Lawyer

Most people don't understand the staggering difference between the responsibilities of a prosecutor and the responsibilities of a criminal defense

Staying Safe Over The Winter Holidays

Staying Safe Over The Winter Holidays

The holidays are the perfect time to get together with friends and family and celebrate. Plenty of parties and fun! This year, with Christmas and New

The Law Firm of Tragos, Sartes, and Tragos Opens New Location in Tampa

The Law Firm of Tragos, Sartes, and Tragos Opens New Location in Tampa

The Law Firm of Tragos, Sartes, and Tragos is pleased to announce the official opening of their Tampa office. This new office brings convenience and

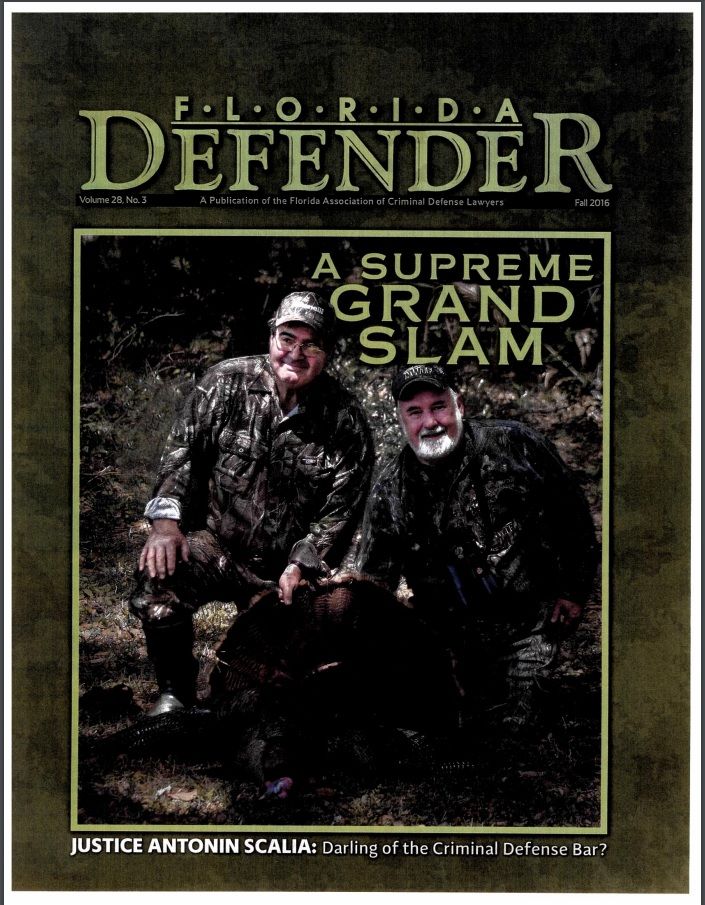

George and Peter Tragos Making a Murderer Article Featured in Florida Defender Magazine

George and Peter Tragos Making a Murderer Article Featured in Florida Defender Magazine

An article about the popular documentary series 'Making a Murderer' written by George and Peter Tragos was featured in the Fall issue of Florida

Clearwater Texting While Driving Lawyer

Cell phones and other electronic devices have become so commonplace in the lives of Floridians that near-constant engagement with them has begun to

Peter Tragos Advocates For Children Involved in Daycare Abuse Case

Peter Tragos Advocates For Children Involved in Daycare Abuse Case

After the son of a day-care operator was arrested on charges of child molestation, previously unknown allegations of sexual abuse back in 2013 against

Florida Legislation on Diversion References Article Written By George Tragos & Peter Sartes

Florida Legislation on Diversion References Article Written By George Tragos & Peter Sartes

On June 17, 2015 Florida Governor Rick Scott approved legislation that amended previous laws to allow defendants eligible for pre-adjudicatory drug

Road Trip Safety Tips

Road Trip Safety Tips

To many American teens, the road trip is the ultimate rite of passage. Hitting the road with your friends, driving down blacktop highways, looking for

Risks of Handling Your Own Clearwater Car Accident Claim

It is a risk for anybody to try and handle a personal injury claim on their own because the insurance company is experienced and handles these matters

Process of a Clearwater Car Accident Claim

Injuries, especially those due to the negligence of another in a car accident, can be devastating and can negatively impact a person's life in a

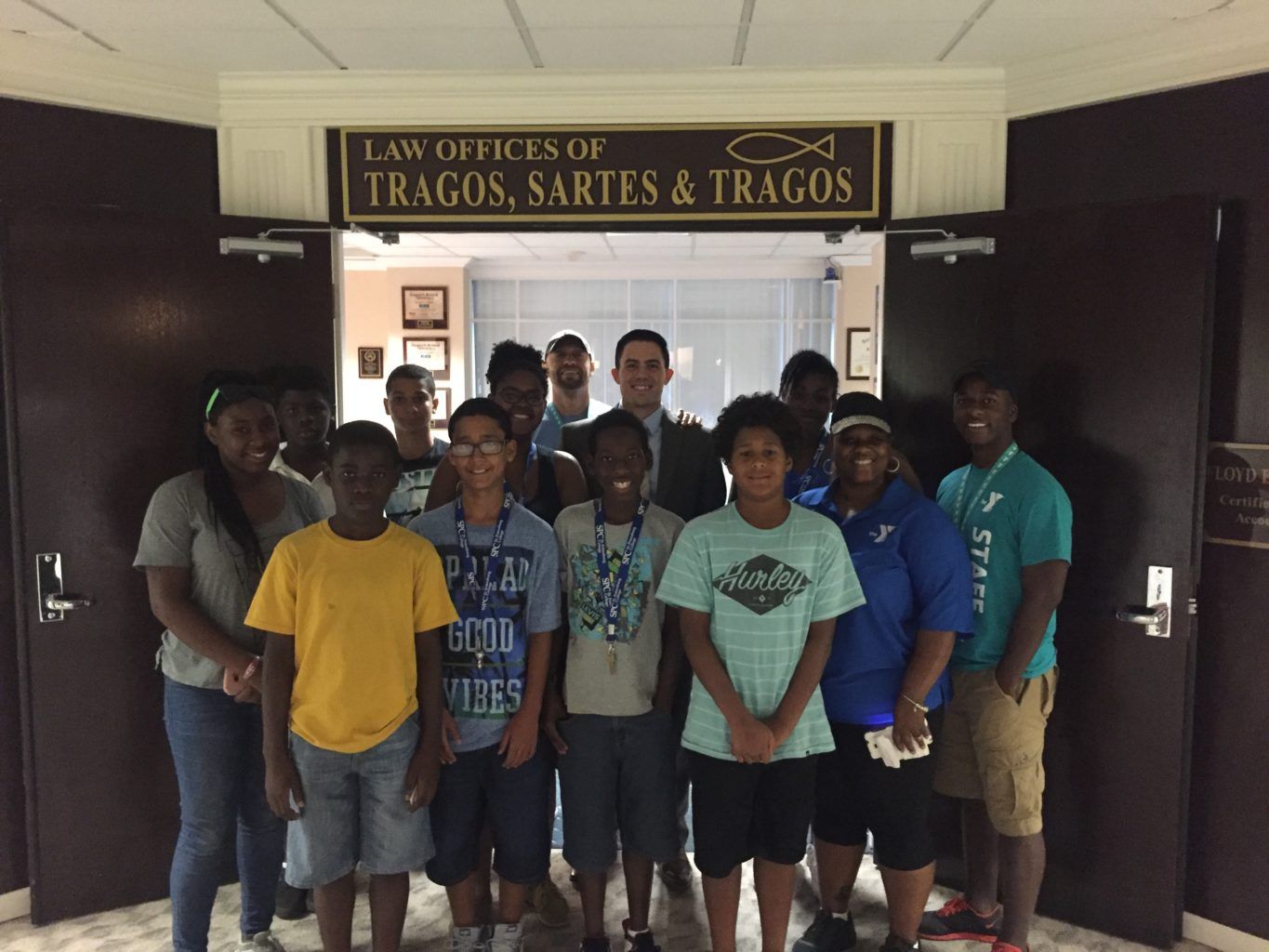

Attorney Peter Tragos Speaks to High Point YMCA About Becoming A Lawyer

Attorney Peter Tragos Speaks to High Point YMCA About Becoming A Lawyer

Peter Tragos spoke to teens today from the High Point YMCA regarding his career as an attorney within the Clearwater, Florida area. He believes in the

Hiring a Lawyer After a Car Accident in Clearwater

A person should hire an attorney after a car accident to make sure that their interests and rights are protected throughout the legal process. Often

Obtaining Police Reports Following a Car Accident in Clearwater

A person can obtain a police report after a car accident in Clearwater by asking the investigating officer for a report number. This number can then

Clearwater School Bus Accidents

Most parents expend a great deal of effort to ensure that their sons and daughters are protected from exposure to needless safety hazards. Once

Are Financial Compensation Awards Taxable?

Are Financial Compensation Awards Taxable?

Victims of personal injury accidents are legally entitled to seek financial compensation from the party at fault for their injuries. However, many

Clearwater Train Accident Lawyer

Although it may come as a surprise, shipping cargo by train is a huge industry in the United States. Practically everything you use on a daily basis

Clearwater Car Accident Injuries

Automobile accidents are a real problem in the United States. According to the National Highway Traffic Safety Administration, there were 37,261 road

Clearwater Taxi Accident Lawyer

Millions of Americans across the United States choose to take taxi cabs when they visit a new city, when they do not have any other form of

Clearwater Road Hazards

If you have ever lived near a construction site, you might be familiar with the effects they can have on driving conditions. Many flats are caused by

Clearwater Go-Kart Injury Lawyer

For many parents, go-karts are fun way they can engage with their kids and teach them about the basics of automobile use. But many of the people who

Clearwater Golf Cart Injury Lawyer

In the absence of bad weather, many people do not consider golf to be an especially dangerous activity. The odds of being injured while swinging a

Faulty Car Repairs in Clearwater

America is a nation built around the automobile. The majority of Americans make regular use of automobiles, and in many areas they are an absolute

Airbag Injuries in Clearwater

There are millions of car accidents each year in the United States. Many of these accidents cause airbags to be deployed. In recent years, car safety

Clearwater ATV Accident Lawyer

Although all-terrain vehicles, or ATVs, can be fun and entertaining to ride, they pose a number of possible dangers that could lead to serious

3 Things to Avoid Following a Car Accident in Clearwater

With over six million car accidents in the United States every year, millions of individuals find themselves having to deal with the aftermath of an

The Importance of Carbon Monoxide Detectors

The Importance of Carbon Monoxide Detectors

According to the American Medical Association, there are approximately 2,100 accidental deaths and 10,000 nonfatal carbon monoxide poisoning incidents

Double Jeopardy and the Fifth Amendment

by Clearwater Criminal Defense Lawyers George E. Tragos & Peter A. Sartes The doctrine of double jeopardy is one of the many safeguards against

So You’re Faced with Child Hearsay? What’s In, What’s Not?

Nothing is more difficult than defending a client who is accused of a crime that requires no substantive evidence for conviction. An allegation is

George E. Tragos Speaks at Golburg-Cacciatore Inns of Court About National Security Issues

Attorney George E. Tragos, a board-certified trial law attorney from our firm was asked to attend a meeting at the prestigious Goldburg-Cacciatore

Clearwater Passenger Injury Lawyer

Passengers and drivers alike may suffer injuries during a car accident. As a passenger, you may not know what your rights are and how you may go about

Clearwater Uninsured Motorist Claims

Being involved in a car accident comes with its own share of difficulties. You may already be overwhelmed with concerns about who was at fault or what

Sealing or Expunction of Criminal History Records: What All Lawyers Need to Know

by Clearwater Criminal Defense Lawyers George E. Tragos & Peter A. Sartes In today's high-tech world, records keeping and retrieval of records

Attorney George Tragos Helps Educate Kids About Litigation Basics

Laws and litigation are one of the most crucial cornerstones in our country and society. To teach this importance to young children who may someday

Peter Tragos & Trinity Spine Center Win R You Safe Charity Golf Tournament

The 6th Annual Charity Golf Tournament for R You Safe was held on May 6th, 2016 in Lutz, Florida at the Cheval Golf and Athletic Club. The Law Offices

Legal TV Blog No. 2: The Grinder

After last week's depressing look at the documentary ‘Making a Murderer’, this week I wanted to touch on something more lighthearted and fun that I

Peter Tragos Attends Countryside High School Speakers Program

The Law Day High School Speakers Program invites prestigious attorneys and legal professionals from all around Clearwater, Florida to speak to high

3 Roadside Emergency Kit Necessities

Dealing with the aftermath of an automobile accident can be extremely difficult, but it can be even more trying if you have to go through it

Jury Says State Farm… Not a Good Neighbor

Our client was 23 years old when he was injured in an automobile crash. The insurance company for both the person who caused the accident and our

Legal TV Show Blog: Making a Murderer

Many doctors don't like watching TV shows that take place in a hospital or depict the ins and outs of the personal relations and struggles that

Avoiding Electrocution Injuries

Electricity might be one of the most important human inventions, but like its predecessor, fire, it presents serious risks as well. By now, given how

George Tragos’ Submission to be Featured by Florida Bar

Attorney George Tragos’ submission to the Florida Bar will be featured as its Presidential Showcase Seminar at the Bar’s annual convention in June

Tragos, Sartes & Tragos Backs Charity Golf Tournament

The Law Offices of Tragos, Sartes & Tragos recently sponsored a hole at the First Annual Holy Trinity Thomas M. Papadakis Memorial Golf Tournament

3 Things You May Not Know about Financial Compensation

Accidents caused by someone else’s negligent actions can be physically and emotionally traumatic, but you shouldn’t have to also suffer financially.

Attorney Tragos Attends Florida Bar Winter Meeting as Traffic Court Rules Committee Member

The 2016 Winter Meeting of The Florida Bar just took place between January 21st and 23rdat the Hilton Orlando Lake Buena Vista. This prestigious event

Tragos & Sartes to Speak at The Clearwater Bar Association People’s Law School

Our Clearwater personal injury attorneys here at the Law Offices of Tragos, Sartes & Tragos are certainly no strangers to giving speeches and

Bus Safety Tips

Every day thousands of children ride the bus to and from school. It is natural for parents to feel a little nervous about this. If your children use

Dangerous Property And Lightning Injuries

Each year, about 5,000 Americans are struck by lightning. About 50 of those individuals pass away. Though lightning is a natural phenomenon, some

Holiday Safe Driving Tips

Holiday Safe Driving Tips

For millions of Americans all across the country, the holiday season – starting just around Thanksgiving and ending after New Year’s Day – also means

Dangers In The Workplace

Many jobs, especially white collar jobs, do not pose any danger to the workers. Offices are usually not dangerous places for people to work in. Other

Dangers of Fireworks

by Clearwater Personal Injury Lawyers Tragos & Sartes Fireworks enthrall many people. From children to adults, people of all ages cannot help

Attorney George Tragos Helps Educate Kids About Litigation Basics

Laws and litigation are one of the most crucial cornerstones in our country and society. To teach this importance to young children who may someday

Dangers of Liposuction

Referred to as lipo, lipoplasty, or liposculpture, liposuction is a cosmetic surgery to remove unwanted and excess fat from certain “problem areas” on

Attorney George Tragos Discussed Constitution Day at the Trinity College of Florida Presentation

Undoubtedly, most Americans recognize or can even recite the famous words of the preamble of the Constitution of United States of America: “We the

Attorney Peter Tragos Represents Passenger from St. Pete-Clearwater Emergency Landing

On June 8th of this year, Allegiant Air made an emergency landing that resulted in the deployment of evacuation slides. In the aftermath, a report by

The Law Offices of Tragos, Sartes & Tragos to Speak For Florida Bar

Attorneys from the Law Offices of Tragos, Sartes & Tragos will speak in a webinar for the Florida Bar tomorrow, Wednesday September 2nd 2015, from

Tragos, Sartes & Tragos Addressed Members of Florida Bar

Our attorneys from the Law Offices of Tragos, Sartes & Tragos in Clearwater have hosted a presentation for members of the Florida Bar. The focus

Dangers of Stadiums

When an athlete takes the field to participate in a game, he or she is at risk of many different injuries. Unfortunately, the fans in the bleachers or

Dealing With Brake Failure

What is the most important safety feature on your vehicle? Seatbelts are an obvious candidate because they have saved millions of lives. Airbags

The Law Offices of Tragos, Sartes & Tragos Welcome New Partner

Our firm is constantly looking for new ways that we can become more successful and better assist our clients. Recently, we made a change that we

Florida DUI Statistics

The most recent year for which the Florida Department of Highway Safety and Motor Vehicles has released information is 2006. In 2006, there were

Where Theres Fire There May Be Negligence

Fire has the ability to provide both heat and light, but it can also prove to be very dangerous. As children, we are taught at great length about the

Florida Tort Reform

by Clearwater Personal Injury Lawyers Tragos & Sartes In October of 1999, the Florida state legislature created a bill that included sweeping

When Is An Employer Liable?

Employees are typically expected to honor the requests of their employers. In some situations, however, these requests can lead to someone suffering a

Withhold of Adjudication: What Everyone Needs to Know

For the benefit of those of you who haven’t thought about criminal law since law school, Florida judges have a special authority vested upon them to

Attorney Peter Tragos Elected to Board of Directors of the Young Lawyers Division of the Clearwater Bar Association

Attorney Peter Tragos has received another prestigious accolade by being elected to the Board of Directors of the Young Lawyers Division of the

Nursing Home Statistics and Regulations

by Clearwater Criminal Defense Lawyers George E. Tragos & Peter A. Sartes Any form of physical, psychosocial, cognitive, or financial harm a

Clearwater Guardrail Safety

When people drive on federal or state funded roadways, they typically assume the roads are safe and will not place motorists in unnecessary harm. One

Attorney Peter Tragos to Host Discussion on Office Technology

Attorney Peter Tragos will be hosting an upcoming event at the Clearwater Campus of St. Petersburg College on May 28 th from noon to 1:00pm He will

Attorney Peter Tragos to Moderate Panel Discussion at St. Petersburg College

Attorney Peter Tragos of the Law Offices of Tragos, Sartes & Tragos will be moderating a civil law seminar at the Clearwater Campus of St.

Peter L. Tragos Selected to the Nation’s Top One Percent List

Attorney Peter Tragos has been welcomed to the 2015 list of the Nation’s Top One Percent lawyers. This attribution has been awarded him by the

Peter Tragos Appointed to the Traffic Court Rules Committee

Attorney Peter Tragos has received the opportunity to serve on the Traffic Court Rules Committee. He has been appointed by the Florida Bar to serve a

Need For Speed Raises Motorcyclist Death Rates

The demand for lighter and faster vehicles continues to grow as motorcycles become more popular with the 20-something crowd. According to the

Attorneys Peter Tragos & Peter Sartes Speak at Clearwater High School Career Day

Attorneys Peter L. Tragos and Peter A. Sartes were asked to talk to the students of Clearwater High School during Career Day about the legal

George Tragos Shares Valuable Knowledge at the Florida Bar Basic Criminal Law Seminar

Attorney George Tragos recently had the privilege of speaking at the Florida Bar Basic Criminal Law Seminar on October 31, 2014 for the third

Peter Sartes Joins the Panel of Experts at the Evidence CLE for the Clearwater Bar Association

When asked to serve on the panel of experts at the Evidence Continuing Legal Education (CLE) for the Clearwater Bar Association, Attorney Peter Sartes

Peter Tragos Speaks at the Evidence CLE for the Clearwater Bar Association

On October 9, 2014, Attorney Peter Tragos spoke at the Clearwater Bar Association’s Evidence Continuing Legal Education (CLE). The event took place at

Peter L. Tragos Speaks on the Topic of Presenting Evidence at Trial

Attorney Peter L. Tragos from the Law Offices of Tragos, Sartes & Tragos was selected as the speaker for the Technology CLE held by the Clearwater

The Law Offices of Tragos, Sartes & Tragos Speak to PTA of Clearwater High School

Some of the members of the Law Offices of Tragos, Sartes & Tragos received the opportunity to speak at Clearwater High School about the effect of

Be the Best Lawyer You Can Be

In honor of Veteran's Day, our firm wanted to remember and thank all the veterans who served our country and continue to do so today. Peter A. Sartes

Why Hire the Law Offices of Tragos, Sartes & Tragos?

We Don’t Get Paid Unless We Win Your Case If you have been injured by someone else's careless, reckless or otherwise negligent actions, it's safe to

Peter Tragos Receives 10.0 “Superb” AVVO Rating

The Law Offices of Tragos, Sartes & Tragos is pleased to announce that Peter Tragos was recently honored with a 10.0 "Superb" rating on Avvo – one

The Dangers of Roller Coasters

Every year, millions of Americans visit Florida for the family-friendly theme parks. There are few things more distinctly American than the rush of

The Dangers Of Stun Guns

Many police officers carry stun guns to subdue disruptive individuals. Stun guns are seen as safe alternatives to traditional handguns to incapacitate